Convert Bank Statement PDF to Excel

Effortlessly convert bank statement PDF to Excel with accurate data extraction. Save time, manage finances better, and stay organized with easy PDF to Excel conversion.

Add Your File

Drag & Drop Or Select File

Data security is our top priority

Bank Statement Converters prioritises the confidentiality and integrity of your data. As a testament to our commitment, we adhere to stringent compliance standards, including GDPR, SOC 2, and HIPAA. Privacy Policy

How to Convert Your Bank Statement PDF To Excel

Why Choose Bank Statement PDF to Excel?

Accessibility

Our platform ensures easy access for everyone, allowing you to convert PDF files, credit card, or bank account statements into Excel easily.

Affordable Plans for Everyone

Affordable Plans for Everyone tailored to meet diverse needs without breaking the bank, offering flexibility and value for all.

Starter

$90 / month

Save 10% annually

Why should you take this

4,800 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Professional

$180 / month

Save 20% annually

Why should you take this

12,000 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Business

$360 / month

Save 20% annually

Why should you take this

48,000 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Most Popular

Enterprise

$Custom / month

Save 20% annually

Why should you take this

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password-Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

How Do PDF to Excel Converters Outperform Scanned OCR?

Features

PDF to Excel Converter

Scanned OCR

Keeps table structure intact

Supports both native and scanned PDFs

Auto recognizes rows and columns

Minimal formatting cleanup needed

Converts dates and numbers correctly

Exports to Excel formats

Handles multi page PDFs

Preserves data accuracy

Works with accounting templates

Faster and fully automated

Frequently Asked Questions

Can I automate the process of converting bank statements to Excel?

What is the fastest way to convert large bank statements?

Can I use a mobile app to convert bank statement PDFs to Excel?

Managing financial data becomes easier when you convert bank statement PDF to Excel. PDFs are fixed formats, making it difficult to extract, edit, or analyze transactions. Manually copying data is time-consuming and can lead to errors.

When you convert a bank statement PDF file to Excel, you get an editable format to organize, filter, and calculate financial records effortlessly.

This article explains the best ways to convert bank statement PDF files to Excel using online tools and software. Whether for accounting, reconciliation, or budgeting, you’ll find the most efficient methods to handle financial data accurately.

What Is a Bank Statement PDF to Excel?

A bank statement PDF to Excel conversion is the process of extracting financial data from a PDF bank statement and converting it into an editable Excel format. This allows you to organize, analyze, and manage transactions easily without manual data entry or formatting issues.

When you receive a bank account statement, it is usually in PDF format, which is secure but not editable. This makes it difficult to extract transaction details, sort data, or perform calculations. Converting bank statement PDF to Excel files allows you to turn static financial records into a structured format that can be modified and analyzed.

With Excel, you can categorize expenses, apply formulas, and generate financial reports efficiently. This is especially useful for accountants, businesses, and individuals who need accurate records for budgeting or tax purposes.

By using reliable conversion tools or software, you can save time, reduce errors, and make financial data management seamless.

Why Do People Convert PDFs into Excel Format?

Converting bank statements from PDF to Excel makes financial management easier and more efficient. PDFs are not editable, limiting how you can work with data. Here’s why you should convert a bank statement to Excel:

Easy Data Editing and Organization

PDF bank statements are fixed, making it difficult to edit or organize transactions. By converting bank statement PDF to Excel, you can sort, filter, and categorize your financial data easily. This helps you manage records efficiently, spot trends, and ensure accurate bookkeeping without manually entering each transaction.

Quick Financial Analysis and Calculations

Excel allows you to apply formulas, generate reports, and analyze financial trends instantly. Converting bank statements PDF to Excel helps you calculate totals, track expenses, and compare monthly transactions without hassle. This is useful for budgeting, tax preparation, and financial planning, saving you time and effort.

Simplifies Accounting and Reconciliation

If you handle finances for a business or personal use, converting bank statement PDF to Excel makes reconciliation easier. You can match transactions with receipts, invoices, or accounting software. This reduces errors, improves accuracy, and ensures your records align with bank transactions for smooth financial tracking.

Saves Time and Reduces Errors

Manually copying transactions from a bank statement is time-consuming and prone to mistakes. When you convert bank statement PDF to Excel, you automate data extraction, reducing human errors. This speeds up your workflow and ensures your financial data remains accurate, making it easier to manage large transaction records.

Better Compatibility with Accounting Software

Most accounting software supports Excel files, but not PDFs. Converting a bank statement PDF to Excel lets you import data into platforms like QuickBooks, Xero, or other financial tools. This eliminates the need for manual entry, simplifying your accounting process and improving efficiency for businesses and individuals alike.

Convert Bank Statements From PDF to Excel in Easy Steps

Working with a PDF bank statement can be tough. You can’t filter or sort easily. Converting it to Excel gives you full control over your data. Here’s how to convert bank statement PDF to Excel:

Choose a Reliable Converter

Pick a trusted tool that works well with bank statements. Look for one that supports table structure, password protection, and scanned documents. Choosing the right converter is the first and most important step to avoid messy data later.

Upload Your PDF File

Click the upload button and select your bank statement PDF from your device. Some tools also allow drag-and-drop. Make sure the file isn’t password protected or too blurry. Clear, digital PDFs work best. After uploading, the tool will read your file and prepare it for conversion.

Set Excel as the Output Format

Before you convert, choose Excel (XLS or XLSX) as the file format. Some tools allow extra options like “detect tables” or “remove empty rows.” Use them if needed. Picking the correct output format ensures your data is ready to use in Excel without extra adjustments.

Start the Conversion

Click the convert button and let the tool process your file. It usually takes just a few seconds. Don’t refresh or close your browser. When it’s ready, a download button or link will appear. Your new Excel file is now available and ready for review.

Download and Review the Excel File

Click to download your converted Excel file. Open it and check if rows, columns, and amounts match the original PDF. Fix small issues like merged cells or misaligned data. Save your file once everything looks clean. Now you can filter, sort, or analyze the data easily.

Who Should Convert Bank Statements from PDF to Excel?

A bank statement in Excel format is useful for anyone who needs to manage, analyze, or track financial transactions efficiently.. Here’s who benefits the most from a bank statement Excel file:

Business Owners and Entrepreneurs

If you run a business, keeping track of income, expenses, and cash flow is essential. A bank statement in Excel helps you organize financial data, create reports, and analyze spending patterns to make informed business decisions and maintain accurate records.

Accountants and Financial Professionals

Accountants need accurate financial data for bookkeeping, tax preparation, and audits. A bank statement in Excel format allows them to categorize transactions, reconcile accounts, and generate financial reports with ease. Thus ensuring accurate record-keeping and compliance with financial regulations.

Freelancers and Self-Employed Individuals

Freelancers and self-employed professionals often deal with multiple income sources and business expenses. An Excel bank statement helps them track payments, organize invoices, and calculate taxes efficiently. Thus making it easier to manage personal and business finances without relying on manual data entry.

Investors and Financial Analysts

Investors and analysts use bank statement data to track cash flow, monitor investment returns, and analyze financial trends. Having transactions in Excel allows for easy calculations, trend analysis, and integration with financial models to make better investment decisions.

Individuals for Personal Budgeting

Managing personal finances becomes easier with a bank statement in Excel. You can track expenses, categorize spending, and create monthly budgets. This helps you control your financial habits, avoid overspending, and plan for future savings or investments effectively.

PDF to Excel Conversion Problems: What to Watch For?

Converting bank statements to Excel may result in formatting errors, missing information, or incorrect values. Identifying these common challenges and applying the right fixes will help maintain accurate financial records. Here is a table outlining typical issues, their causes, and effective solutions.

Issues | Causes | Solutions |

Data is Misaligned | PDF formatting does not match Excel columns | Use “Text to Columns” or adjust column widths manually. |

Missing Transaction Details | Some text is not recognized during conversion | Check for hidden data and use OCR tools for scanned PDFs. |

Incorrect Date Formatting | Excel does not recognize the date format | Select the column, go to “Format Cells,” and choose the correct date format. |

Currency Not Displaying Properly | Excel treats numbers as text | Convert text to numbers using Excel’s “Value” function and apply currency formatting. |

Extra Blank Rows and Columns | Unnecessary spaces from PDF structure | Use the “Find & Select” tool in Excel to remove blank rows and columns. |

Merged or Combined Data in One Cell | PDF data is not structured properly | Use Excel’s “Text to Columns” feature or manually split the data. |

Duplicate Transactions | Errors in conversion or repeated data in PDF | Use Excel’s “Remove Duplicates” feature to clean up the data. |

Unrecognized Special Characters | Encoding issues during conversion | Use “Find & Replace” in Excel to remove or replace unwanted symbols. |

Incorrect Decimal or Number Formatting | Regional settings differ from Excel’s format | Adjust number formatting in Excel under “Format Cells.” |

Large File Size Causes Slow Performance | Too much data or unnecessary formatting | Remove unnecessary formatting and save the file in XLSX instead of CSV for better efficiency. |

Tips for Choosing a Bank Statement PDF to Excel Converter

Selecting the best bank statement converter ensures accurate data extraction, security, and efficiency. With various options available, it's important to consider key factors that match your financial needs. Here’s what to look for when choosing the right bank statement converter:

Strong Security and Privacy Measures

Since bank statements contain sensitive information, choose a converter that offers encryption and strict data protection policies. Avoid tools that store or share your financial data and opt for software that keeps your files secure.

Multiple File Format Support

A good converter should allow conversions between PDF, Excel, CSV, and other formats. This flexibility helps with easy data integration into different accounting systems and financial tools without compatibility issues.

Integration with Accounting Software

If you use accounting software like QuickBooks, Xero, or Sage, ensure the converter can directly export data to these platforms. This avoids manual imports and improves efficiency in financial management.

Batch Processing for Multiple Files

If you manage multiple bank statements, choose a converter that supports batch processing. This feature enables you to convert multiple PDFs at once, saving time and improving workflow efficiency.

Affordable Pricing and Flexible Plans

Some converters offer free versions with limitations, while others require a subscription. Compare pricing plans based on your needs and choose one that provides the best features without unnecessary costs.

How Does PDF to Excel Converters Work for Bank Statements?

Bank statement converters help transform PDF bank statements into editable Excel or CSV files, making financial data easier to manage. These tools automate the extraction process, saving time and reducing errors. Here’s how bank statement converters work:

Extracts Data from PDF Files

Bank statement converters scan and extract financial data from PDFs. They recognize transaction details such as dates, descriptions, amounts, and balances, ensuring that all important information is captured accurately without manual entry.

Organizes Data into Structured Columns

Once extracted, the converter arranges transaction details into separate columns such as date, description, debit, credit, and balance. This structured format makes it easier to sort, filter, and analyze financial data efficiently.

Applies Formatting and Standardization

To ensure readability, the converter formats numbers, dates, and currency symbols correctly. Some tools also allow customization, enabling you to set preferred formats, categorize transactions, or remove unnecessary text for cleaner data presentation.

Exports Data to Excel, CSV, or Accounting Software

After processing, the converted data can be exported into Excel, CSV, or directly integrated into accounting software like QuickBooks or Xero. This helps in financial tracking, tax preparation, and reconciliation.

Supports Batch Processing for Multiple Statements

Advanced bank statement converters allow batch processing, enabling you to convert multiple PDF statements at once. This feature is useful for businesses and accountants handling large volumes of financial data.

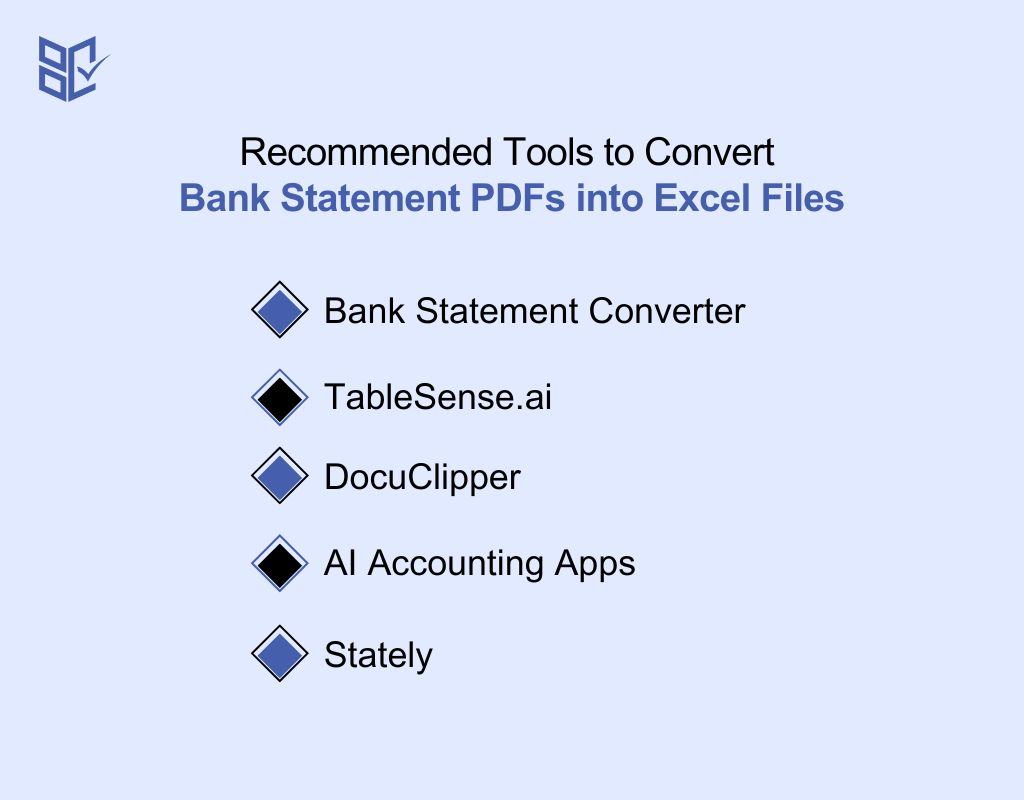

Recommended Tools to Convert Bank Statement PDFs into Excel Files

Converting bank statements from PDF to Excel can simplify financial data management. Here are some top bank statement converters to consider:

Bank Statement Converter

This tool converts bank statement PDFs from thousands of banks worldwide into clean Excel (XLS) format. It prioritizes security and accuracy, making it a reliable choice for financial professionals and businesses. It ensures that data remains intact without formatting errors or missing details.

TableSense.ai

TableSense.ai is an AI-powered bank statement converter that transforms unstructured PDF data into Excel, CSV, or JSON formats. Supporting over 1,000 banks globally, it provides high-speed conversion with minimal errors. Its advanced AI algorithms ensure accuracy, making it an efficient choice for data extraction and analysis.

DocuClipper

Ranked #1 on G2, DocuClipper automatically extracts transaction details from any PDF bank or credit card statements into Excel, CSV, and QuickBooks. It supports statements from all banks, ensuring quick processing with high accuracy. Ideal for accountants and businesses needing seamless financial data management.

AI Accounting Apps

This AI-powered tool converts bank statements from PDF, photos, and screenshots into Excel, CSV, OFX, and QBO formats. Supporting over 1,000 banks, it simplifies financial tracking and bookkeeping without requiring a signup. Its intelligent OCR technology helps extract data even from complex or scanned documents.

Stately

Stately offers fast and accurate PDF to Excel conversion for bank statements from various financial institutions. It ensures proper column formatting, making data easier to analyze and organize. This tool is designed for professionals who require reliable, error-free financial data extraction within seconds.

Conclusion

Converting bank statements from PDF to Excel is a game-changer for managing financial data with ease. Instead of struggling with static PDFs, you get a fully editable spreadsheet where you can sort, filter, and analyze transactions effortlessly.

Whether you’re tracking expenses, preparing taxes, or handling business finances, Excel gives you the flexibility to work smarter. To make the process seamless, choose a converter that delivers accurate results while keeping your data secure. Always double-check the output for errors, especially in dates and amounts.

With the right tool and careful attention, you can convert bank statement PDF to Excel efficiently, and take full control of your financial records!