Convert Bank Statement to CSV

Need to convert bank statement to CSV? Follow this guide to turn your bank data into clean, structured files that work with spreadsheets and tools easily.

Add Your File

Drag & Drop Or Select File

Data security is our top priority

Bank Statement Converters prioritises the confidentiality and integrity of your data. As a testament to our commitment, we adhere to stringent compliance standards, including GDPR, SOC 2, and HIPAA. Privacy Policy

How to Convert Bank Statement to CSV Format

Why Choose Convert Bank Statement to CSV?

Accessibility

Bank Statement Converter is designed to be simple and usable for everyone. Whether you're tech-savvy or not, the tool works easily across devices, browsers, and operating systems without installation.

Affordable Plans for Everyone

Affordable Plans for Everyone tailored to meet diverse needs without breaking the bank, offering flexibility and value for all.

Starter

$90 / month

Save 10% annually

Why should you take this

4,800 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Professional

$180 / month

Save 20% annually

Why should you take this

12,000 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Business

$360 / month

Save 20% annually

Why should you take this

48,000 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Most Popular

Enterprise

$Custom / month

Save 20% annually

Why should you take this

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password-Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Bank Statement to CSV Converter vs. Manual Entry: What’s More Reliable?

Features

Bank Statement to CSV Converter

Manual Entry

Speed of Conversion

Human Error Free

Handles Large Data Sets

Consistency in Formatting

Auto Detection of Fields

Export Compatibility (CSV, XLSX)

Repeatable Process

Audit Ready Output

Time & Cost Efficiency

Suitable for Business Use

Frequently Asked Questions

What columns will appear in the CSV file?

Can I upload multiple statements at once?

Will converting to CSV affect my original file?

Over 70% of accounting and finance platforms now rely on CSV imports to process transactions accurately. That means converting your bank statements into CSV isn’t optional—it’s essential for smooth integration and quick data handling.

With CSV, your financial records become editable, easy to organize, and compatible with most modern software.

In this guide, you’ll learn how to convert bank statement to CSV in a few simple steps. Whether you're tracking expenses or submitting reports, you’ll find secure methods that save time and prevent common formatting errors.

What Is a CSV Bank Statement?

A CSV bank statement is a simple text file where each transaction is stored in rows and columns. It uses commas to separate values like date, amount, and description. This format is lightweight, editable, and works with most accounting tools, spreadsheets, or data software.

When you download your bank statement as a CSV file, you're getting a raw version of your financial data. Each line represents a transaction, and the details—like the date, amount, and type—are separated by commas.

Unlike PDF or Excel formats, there's no styling or formatting. It's just clean, organized data that can be opened with almost any Excel spreadsheet program.

CSV is especially useful if you're importing your bank transactions into budgeting tools, accounting software, or custom dashboards. Since it's a plain text format, it loads quickly and reduces the chances of compatibility issues.

Bank Statements to CSV: What’s the Real Advantage?

If you're wondering why so many people prefer the CSV format over PDF or Excel, you're not alone. Here's why converting your bank statement to CSV can make your financial tasks easier:

Easy to Import into Financial Tools

CSV files are accepted by most accounting tools, including QuickBooks, Xero, and budgeting apps. You won’t have to manually copy data or deal with formatting issues. Just upload the CSV, and the tool reads it. This makes your finance tracking faster and less prone to errors during file imports.

Clean and Lightweight Format

Unlike Excel or PDF, CSV files don’t include extra formatting or visual clutter. They only contain raw data in rows and columns. That makes them small in size and super fast to open, even on older computers. If you need something simple and efficient, CSV is the best choice.

Works Across All Platforms

CSV files open in Excel, Google Sheets, LibreOffice, and even basic text editors. You don’t need specific software to access or edit the data. Whether you're on Windows, Mac, or Linux, CSV keeps your bank data flexible and accessible without the need for expensive tools or complex setups.

Better for Custom Analysis

When you're working with CSV, it's easier to filter, sort, and analyze your data. You can quickly check spending patterns, find duplicate charges, or group transactions by category. This flexibility makes CSV ideal for people who like to dive deeper into their finances and customize reports their way.

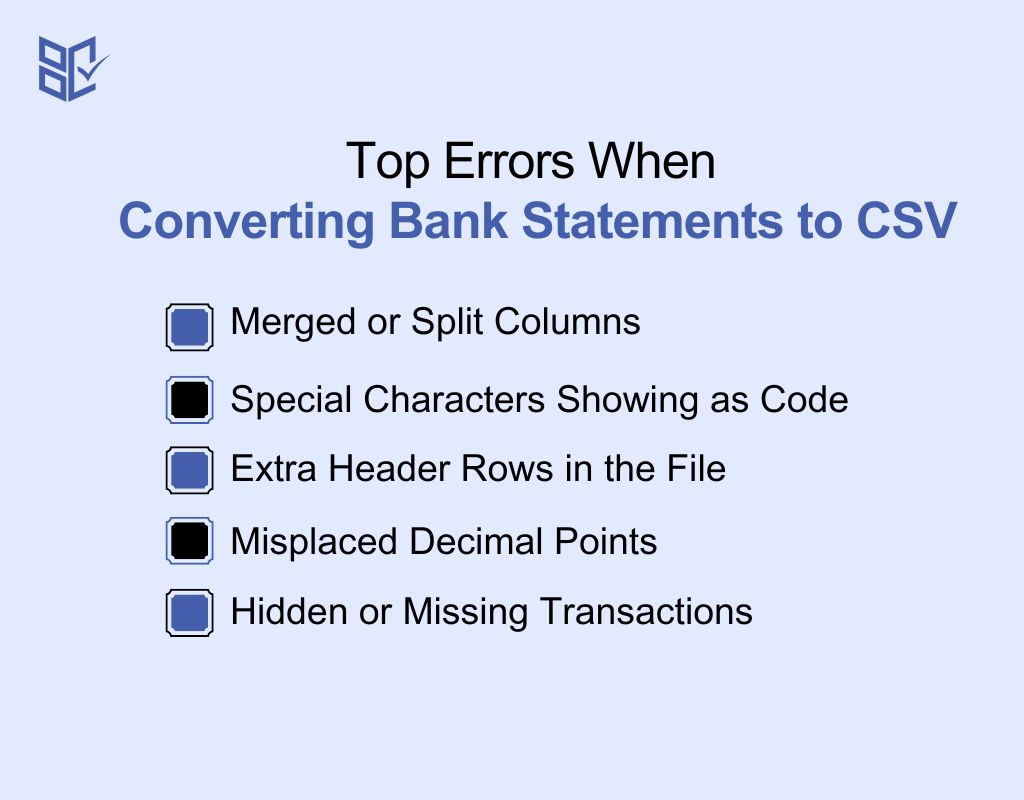

Top Errors When Converting Bank Statements to CSV

While converting bank statements to CSV can be quick, you might still face small issues. Here are some common problems people run into—and how you can fix them easily:

Merged or Split Columns

Sometimes, data from one column spills into two, or two columns get merged into one. This often happens when table structure isn’t detected properly. To fix it, use a tool that lets you manually adjust column alignment before exporting. Double-check the preview screen and drag columns into place if needed.

Special Characters Showing as Code

Occasionally, special symbols like “&” or “€” may appear as weird codes (e.g., &, €). This happens due to encoding mismatches. To fix this, save your CSV in UTF-8 format. Most online converters and spreadsheet tools allow you to choose the correct encoding before download or during the save process.

Extra Header Rows in the File

Sometimes bank statements include extra rows at the top for account info or titles. When converted, these may stay in your CSV and cause errors. You should manually delete those non-data rows after conversion to keep only the column headers and transactions. This ensures smooth imports and cleaner analysis.

Misplaced Decimal Points

You may see strange numbers like “12500.0” instead of “125.00” due to regional settings or format misreads. Check the number format in your spreadsheet after conversion. Set the decimal separator to a period (.) and adjust number precision if needed. This keeps your amounts accurate and properly displayed.

Hidden or Missing Transactions

Sometimes, a few transactions may not appear in your CSV. This could be due to poor table detection or OCR failure. Always scan your statement before uploading. If a page is blurry or tilted, try rescanning or using a clearer file. Use a converter with preview mode to catch issues early.

Real-World Uses of Bank Statement to CSV Conversion

Converting your bank statement to CSV isn’t just for organization. It opens up many possibilities across personal, business, and finance tasks. Here are some practical ways you can use it:

Personal Budget Tracking

With your bank statement in CSV format, you can easily track your spending habits. Use spreadsheet tools to sort by category, highlight monthly expenses, and set budget goals. It helps you clearly see where your money is going—and where you can cut back or save more over time.

Small Business Accounting

CSV files make bookkeeping easier for small businesses. You can upload them directly into tools like QuickBooks or Wave. This speeds up monthly reconciliation, tax preparation, and expense tracking without having to enter data manually. It’s perfect for staying organized and avoiding costly accounting mistakes.

Loan and Visa Applications

Some institutions require transaction history in CSV format for faster review. Whether you’re applying for a loan, mortgage, or visa, having your bank statement as a CSV makes it easier to submit clean, readable financial records. It helps agencies quickly verify your income and financial stability.

Financial Auditing and Reporting

Auditors and accountants prefer working with CSV files because they allow for faster analysis. You can use filters, pivot tables, and formulas to spot inconsistencies, check totals, or group data by category. CSV format saves time and helps ensure financial reporting is accurate and transparent.

Importing into Budgeting Apps

Most personal finance and budgeting apps—like YNAB or PocketGuard—accept CSV files. You can upload your transactions directly and let the app organize them into categories. This saves you hours of manual entry and gives you instant insights into your financial behavior and cash flow.

CSV vs Excel for Bank Data Analysis

Choosing between CSV and Excel depends on how you handle bank data. Here’s a quick comparison to help you pick the right format for your needs:

Feature | CSV | Excel |

File Size | Very small | Larger due to formatting |

Ease of Import to Tools | Excellent (universally supported) | Good, but not always compatible |

Formatting Support | None (plain text only) | Full support (fonts, colors, tables) |

Formulas and Calculations | Not supported natively | Fully supported |

Multi-Sheet Support | No | Yes |

Speed for Large Files | Loads Faster | May slow down with large data sets |

Editing Simplicity | Simple, less cluttered | Rich editing features |

Automation / Scripting | Easy to parse for scripts | Requires Excel-specific tools |

Best For | Clean imports, raw data processing | Advanced analysis, reporting, visualizations |

Software Needed | Any text editor or spreadsheet app | Excel or Excel-compatible app |

Top Tools to Convert Bank Statement to CSV

If you need to convert your bank statement to CSV, choosing the right tool can save you time and reduce errors. Here are five reliable options to convert bank statement to CSV online:

Bank Statement Converter

Bank Statement Converter is a dedicated online tool made just for bank statement conversion. It supports CSV, Excel, and PDF output, handles scanned files with OCR, and protects your data with automatic file deletion. You don’t need to install anything—just upload, convert, and download your clean, structured file.

PDFTables

PDFTables is a general-purpose tool that lets you convert PDF bank statements into CSV or Excel. It offers decent table detection and works well for structured documents. However, it’s less accurate with scanned files and doesn’t have financial-specific formatting features. Still, it’s a solid option for clear PDFs.

Zamzar

Zamzar is a well-known file converter that supports many formats, including PDF to CSV. It’s web-based and doesn’t require installation. However, it lacks table recognition features, so it may not always keep the structure of your bank statement intact. It’s best for simple and non-scanned files.

Adobe Acrobat Pro

Adobe Acrobat Pro lets you export PDF bank statements to Excel or CSV manually. It works well if your PDF is digitally generated, but it’s not ideal for scanned files unless you tweak OCR settings. It’s also paid software, so consider it if you need a multi-feature PDF editor.

Cometdocs

Cometdocs is an online document converter that supports PDF to CSV tool conversion. It works with both scanned and native PDFs. The free version has limits, and sometimes conversion results need cleanup. Still, it’s a helpful tool if you occasionally convert bank data and prefer something lightweight and online.

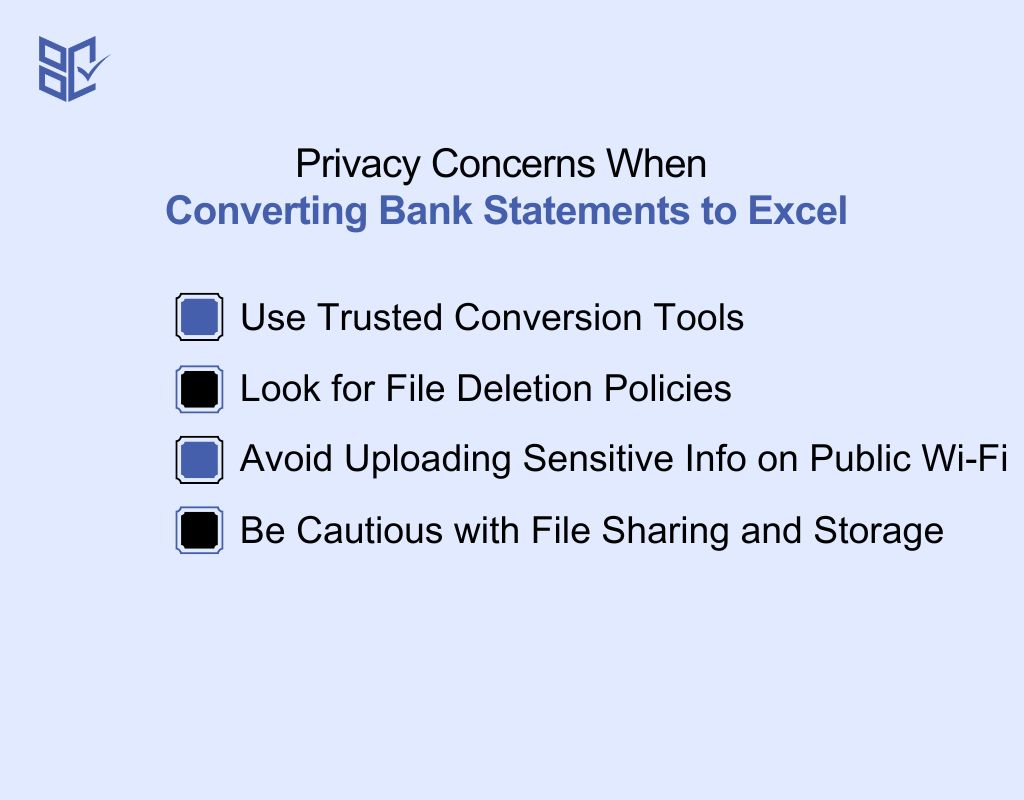

Privacy Concerns When Converting Bank Statements to Excel

When handling bank statements, your financial data needs to stay protected. Whether you're using an online tool or local software, here’s what to consider to keep everything secure:

Use Trusted Conversion Tools

Always choose tools with a good reputation. Look for HTTPS in the URL and read user reviews. Trusted platforms clearly state their data privacy terms. Using unknown tools could expose your data to third parties or malware. It’s better to stay safe and stick to verified options.

Look for File Deletion Policies

Check if the tool deletes your file after conversion. Many good services automatically remove your uploaded files within minutes or hours. For example, Bank Statement Converter deletes files within 24 hours. This ensures your sensitive financial data doesn’t remain stored online longer than necessary.

Avoid Uploading Sensitive Info on Public Wi-Fi

Don’t upload your bank statements over public or unsecured Wi-Fi. These networks can be risky and make it easier for hackers to intercept your data. Instead, use a secure, private connection when converting files. It adds an extra layer of protection to keep your financial info safe.

Be Cautious with File Sharing and Storage

After converting your file, avoid uploading it to public drives or sharing it through unsecured messaging apps. Instead, use encrypted cloud storage or password-protected folders. Even if your data is safe during conversion, it can still be exposed later if not handled carefully.

Conclusion

When you convert bank statement to CSV, you make your financial data easier to use and manage. It turns cluttered files into clean, editable formats that work with most tools.

In just a few steps, you can track spending, prepare reports, or manage budgets more efficiently. Whether for personal use or tax prep, CSV makes handling your finances easier and faster. Choose the method that suits your needs and let your data work for you—not the other way around.