PDF to CSV Converter

Convert PDF to CSV easily with accurate data extraction. Use a reliable PDF to CSV converter to simplify your workflow and save time on manual data entry.

Add Your File

Drag & Drop Or Select File

Data security is our top priority

Bank Statement Converters prioritises the confidentiality and integrity of your data. As a testament to our commitment, we adhere to stringent compliance standards, including GDPR, SOC 2, and HIPAA. Privacy Policy

How to Convert from PDF to CSV

Why Choose PDF to CSV Converter?

Accessibility

Our platform is designed for easy CSV conversion across all devices and skill levels. Whether using desktop or smartphone, you can convert PDFs to Excel or CSV format anytime.

Affordable Plans for Everyone

Affordable Plans for Everyone tailored to meet diverse needs without breaking the bank, offering flexibility and value for all.

Starter

$90 / month

Save 10% annually

Why should you take this

4,800 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Professional

$180 / month

Save 20% annually

Why should you take this

12,000 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Business

$360 / month

Save 20% annually

Why should you take this

48,000 pages per year

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Most Popular

Enterprise

$Custom / month

Save 20% annually

Why should you take this

PDF Bank Statement to Excel

PDF Bank Statement to CSV

Convert Password-Protected Statement

Multiple PDFs to a Single CSV

Global Banks Supported

Get Started

Why PDF to CSV Converter is Better than Others?

Features

PDF to CSV Converter

Generic Tools

No File Size Limit

Smart Header Recognition

Real Time Preview Before Download

Split or Merge Columns Easily

Works on Mobile and Tablet

Drag and Drop Cloud Import Options

File Recovery for Interrupted Sessions

Auto Detect Currency and Localization

Multi

Detailed Conversion Logs for QA Checks

Frequently Asked Questions

Do I need to install software to convert PDFs to CSV?

Can I convert multiple PDF files to CSV at once?

What software can open CSV files after conversion?

Converting PDF files to CSV is a smart way to work with structured data. While PDFs are great for viewing, they aren’t built for editing or analysis. By switching to CSV, you can organize tables, extract information, and upload data into other tools with ease.

Many use PDF to CSV converters for reporting, audits, analytics, or recordkeeping. You can convert files manually, use online tools, or try OCR and AI-based methods for faster and more accurate results.

This guide walks you through the best ways to convert PDF to CSV—quickly, reliably, and with minimal effort.

What Is a PDF to CSV Converter?

A PDF to CSV converter is a tool that extracts tabular data from PDF files and converts it into a CSV (Comma-Separated Values) format. This makes financial records, invoices, and statements easier to edit, analyze, and integrate into spreadsheets or accounting software.

PDF to CSV converter helps you transform non-editable PDF documents into structured CSV files. Since PDFs are designed for viewing rather than editing, extracting data manually can be time-consuming.

Converting them to CSV allows you to store data in a structured format, making it easier to organize and use in applications like Excel, Google Sheets, or accounting software.

There are different types of PDF to CSV converters available—manual methods, online tools, OCR-based solutions for scanned PDFs, and AI-powered converters for high accuracy. The right choice depends on the complexity of your PDF and the level of precision you need.

With the right tool, you can save time and minimize errors in financial or business data processing.

Why Should You Convert Files From PDF to CSV?

PDFs are great for viewing, but not for working with data. Converting PDF files to CSV gives you more flexibility, saves time, and makes data editing and analysis easier. Here’s how:

Edit and Organize Data Easily

PDFs lock your content, but CSV files open it up. Once converted, you can sort, update, and arrange data as needed. This is helpful when managing tables, item lists, or survey responses in a more flexible and useful way.

Import Directly Into Software

Most data tools work better with CSV files. Whether you're using Excel, Google Sheets, or business software, converting your PDFs lets you upload and use your data directly—no retyping or copying needed.

Speed Up Reporting and Analysis

CSV format makes it easy to filter, group, or calculate. You can turn plain tables into graphs, dashboards, or summaries. It’s perfect for fast reporting or digging deeper into your data without delays.

Simplify Record Keeping and Audits

Converting to CSV helps keep clean records. You can store, sort, and retrieve data quickly when you need to. It’s helpful for audits, monthly reviews, or long-term tracking of entries, changes, or patterns.

Automate Bulk File Processing

Have many files to convert? CSV-friendly tools can batch-process PDF data, helping you save time on repetitive work. Automation makes it easier to manage large volumes of files with less manual effort.

Avoid Copy-Paste Mistakes

Manually copying from PDFs leads to errors. A PDF to CSV converter keeps data structure and values intact. You won’t miss rows or misplace decimal points—your data stays clean and consistent every time.

How Do You Convert PDF Files to CSV Format?

If your data is stuck in a PDF, it's not easy to work with. Converting it to CSV helps you open it in Excel or Google Sheets and manage it better. Here’s how to do it:

Choose a Trusted PDF to CSV Converter

Find a tool that turns PDFs into CSV format. You can use free or paid options. Always check if it supports table detection and can accurately extract PDF info. Good converters keep the structure clean. Avoid tools that mess up rows or drop values during conversion.

Upload Your PDF File

Go to the converter’s site and upload your PDF. You can usually click “Upload” or drag and drop your file. Make sure the file isn’t password-protected or scanned as an image. Clear, text-based PDFs give better results. Wait for the upload to finish before moving to the next step.

Select CSV as the Output Format

Once the file is uploaded, choose CSV as your output format. Some tools ask you to pick between Excel, Word, or CSV. Make sure to select CSV so your data exports in a simple, comma-separated format. This keeps your data lightweight and easy to open in any spreadsheet program.

Start the Conversion Process

Click the “Convert” button to begin. The tool will read your PDF and turn the content into CSV format. This usually takes a few seconds. Don’t close the page or refresh your browser. When it’s done, you’ll get a link or button to download the converted file.

Download and Check Your CSV File

Download your new CSV file and open it. Use Excel or Google Sheets to view it. Check that the rows, columns, and values match your original PDF. Fix any minor issues like shifted cells or missing headers. Save the final file when everything looks correct and ready to use.

Who Benefits from PDF to CSV Conversion?

Not sure if you need a PDF to CSV converter? If you work with data stored in PDF files, this tool can save time and effort. Here’s who benefits the most:

Accountants and Bookkeepers

You often deal with reports, invoices, and statements locked in PDF files. A converter helps you pull that data into spreadsheets quickly. This makes it easier to organize finances, spot errors, and prepare reports without typing everything out by hand.

Small Business Owners

Running a business means handling orders, payments, and inventory reports. These often come in PDF format. With a converter, you can transfer that data into Excel or software for analysis, tracking, and planning—without needing to be an expert.

Freelancers and Consultants

Invoices, payment receipts, or project summaries are often shared as PDFs. Converting them to CSV helps you organize earnings, prepare tax documents, or create summaries to share with clients or accountants in just a few clicks.

Data Analysts and Researchers

You work with survey data, reports, or large documents. PDFs make it hard to sort or analyze that data. A converter lets you shift everything into CSV, so you can run filters, build charts, or find insights much faster.

Students and Educators

Educational resources, research papers, or data sets often come in PDF format. By converting them to CSV, you can manage information better—great for assignments, class tracking, or research projects that involve numbers and tables.

How to Fix Common Errors in PDF to CSV Conversion

Converting PDFs to CSV can sometimes result in errors due to formatting, data misalignment, or encoding issues. Below is a table highlighting common issues, their causes, and how to fix them:

Issue | Cause | Solution |

Incorrect Column Alignment | Conversion tool misinterprets table structure | Manually adjust columns in Excel or use advanced conversion tools. |

Missing Transaction Data | PDF formatting errors or tool limitations | Use an accurate PDF to CSV converter or manually check missing data. |

Date Format Errors | Different regional date formats in PDF | Standardize all dates in CSV using Excel’s date formatting feature. |

Extra Spaces and Special Characters | Hidden characters or formatting issues in PDF | Use ‘Find and Replace’ in Excel to remove extra spaces and special characters. |

Numbers Stored as Text | CSV stores numbers as text due to incorrect formatting | Convert text to numbers using Excel’s ‘Format Cells’ feature. |

Duplicate Transactions | Duplicate entries in the original PDF or conversion errors | Use Excel’s ‘Remove Duplicates’ feature or filter data manually. |

Scanned PDFs Not Converting Properly | OCR tool fails to recognize text in scanned PDFs | Use OCR tools with better accuracy like Adobe Acrobat or AI-powered converters. |

How to Choose the Best PDF to CSV Converter

Not all PDF to CSV converters give the same results. If you want clean, usable data without extra work, here are the key things to check before choosing the right tool:

Accuracy in Data Extraction

The converter should copy your data exactly—no missing rows, no misplaced values. It must keep table layouts, columns, and numbers aligned. Accurate extraction ensures you don’t spend time fixing errors after conversion.

Support for Scanned PDFs (OCR)

If your file is scanned or image-based, make sure the tool includes OCR (Optical Character Recognition). OCR lets it read and convert text from images, so you get editable CSV files even from photos or scans.

Batch Processing Option

Need to convert more than one file? Choose a tool with batch processing. It saves you from repeating the same steps for each file. Great for handling folders of PDFs quickly and efficiently.

Integration with Other Software

Make sure the CSV files work smoothly with your tools—like Excel, Google Sheets, or business platforms. A good converter produces clean, well-formatted CSV files that upload easily into your workflow without extra tweaks.

Strong Data Privacy and Security

PDFs can contain private info. Always pick a converter that offers encryption and deletes files after processing. Avoid tools without clear privacy policies to keep your data safe from misuse or leaks.

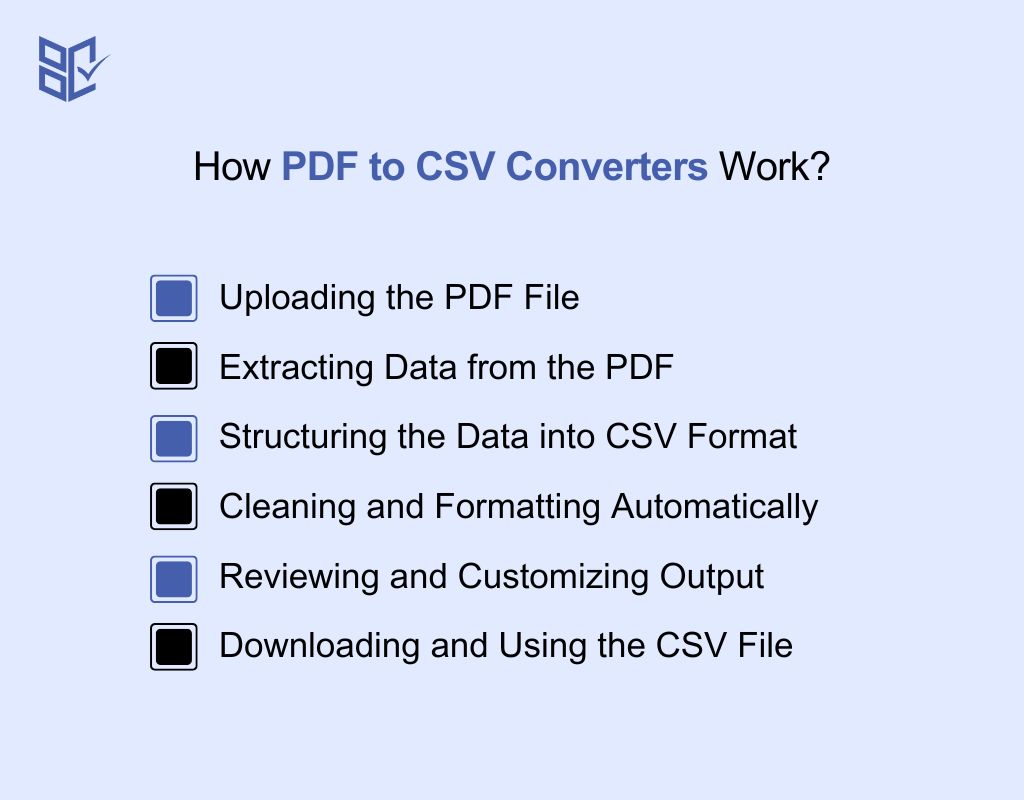

How PDF to CSV Converters Work?

PDF to CSV converters turn unreadable documents into usable data. Whether you're handling tables, reports, or lists, these tools simplify the process. Here's how they work, step-by-step:

Uploading the PDF File

Start by selecting the PDF file you want to convert. Most tools let you drag and drop or browse your device. It’s quick and doesn’t need installation—just upload your file and the tool takes it from there.

Extracting Data from the PDF

The tool scans your file and picks out the data—like text, numbers, and table structure. If your PDF is scanned or image-based, OCR (Optical Character Recognition) is used to read the content accurately before conversion.

Structuring the Data into CSV Format

Once the content is detected, the converter organizes everything into rows and columns. This ensures your CSV file keeps the correct layout, with clear headers and aligned values, making it easier to read and use.

Cleaning and Formatting Automatically

Many converters clean your data by removing odd symbols, extra spaces, or blank cells. Some also fix number formats or standardize dates. Cleaned data makes your CSV file ready for editing, analysis, or importing.

Reviewing and Customizing Output

Before you download, some tools let you preview the file. You can adjust column names, reorder fields, or choose what data to keep. This step ensures your final CSV matches your specific needs or system requirements.

Downloading and Using the CSV File

Once done, you download the CSV file. It’s now ready to open in Excel, Google Sheets, or upload into software. You can sort, filter, or analyze the data as needed—without copying anything by hand.

Best Options to Convert PDF Data to CSV Easily

If you're dealing with tables, reports, or lists in PDF format, these PDF to CSV converters can save time and effort. Here are the top tools that deliver fast, accurate results:

Bank Statement Converter

BankStatementConverters.com is a fast, secure, and AI-powered PDF to CSV converter. It supports scanned and digital files, maintains accurate formatting, and delivers clean CSV output with minimal manual editing. With batch processing, UTF-8 encoding, and no signup required.

TableSense.ai

TableSense.ai uses machine learning to extract table data from PDFs and convert it into CSV, Excel, or JSON formats. It supports thousands of file types and layouts, including scanned documents. Ideal for users needing clean, automated data conversion for spreadsheets, reporting tools, or importing into software platforms.

DocuClipper

DocuClipper converts PDF files into well-organized CSV or Excel sheets. It detects tables, processes large files quickly, and integrates with accounting and spreadsheet tools. The platform is easy to use and provides accurate output for a wide range of document types—making it a trusted option for professionals and teams.

Nanonets PDF Converter

Nanonets is a free PDF file to CSV OCR-based converter that works with scanned and digital PDFs. You can upload up to 500 pages without sign-up. It pulls table data and turns it into CSV or Excel formats with precision. Best for bulk document conversion and users looking for a no-hassle experience.

StatementConvert.com

StatementConvert offers quick PDF to CSV or Excel conversion with a clean interface. It lets users select specific tables, so you only convert what you need. The platform supports many document layouts and focuses on accurate formatting. A solid pick for users who want speed, control, and simplicity in one tool.

Conclusion

If you're working with data locked in PDFs, converting it to CSV is a practical move. It turns static content into structured, editable files you can actually work with.

From organizing information to simplifying imports and analysis, the right PDF to CSV converter makes a real difference. Choose a tool that’s accurate, secure, and fits your workflow.

With a clean conversion and proper formatting, your data becomes easier to manage—and your work gets done faster.