PDF Bank Statement: How to Convert, Edit, and Use It Right

Bank Statement

Aug 26, 2025

Managing your finances just got easier with PDF bank statements. These digital documents provide a detailed record of your account activity, including deposits, withdrawals, and balances—all in a secure and easy-to-access format.

Instead of dealing with paper clutter, you can now track your transactions anytime, anywhere. That’s why more people are choosing PDF statements for everyday use.

In this guide, you’ll discover everything you need to know about PDF bank statements. From understanding their structure and benefits to learning how to download, convert, and use them for budgeting, tax prep, and more.

What Is a PDF Bank Statement?

A PDF bank statement is a digital file that shows your financial transactions over a specific period. It includes details like account activity, balances, and fees. Banks provide it in PDF format so you can view, save, or print your statement easily and securely.

When you log in to your online banking account, you’ll often see an option to download your statements as PDF files. This document is a clear summary of your account's monthly or quarterly activity. It lists all deposits, withdrawals, fees, and other transactions made during the selected period.

PDF statements are easy to store, share, or use for official purposes like loan applications, tax filing, or proof of income. They’re also safer than printed papers since you can keep them protected with passwords and access them from your phone, laptop, or cloud whenever needed.

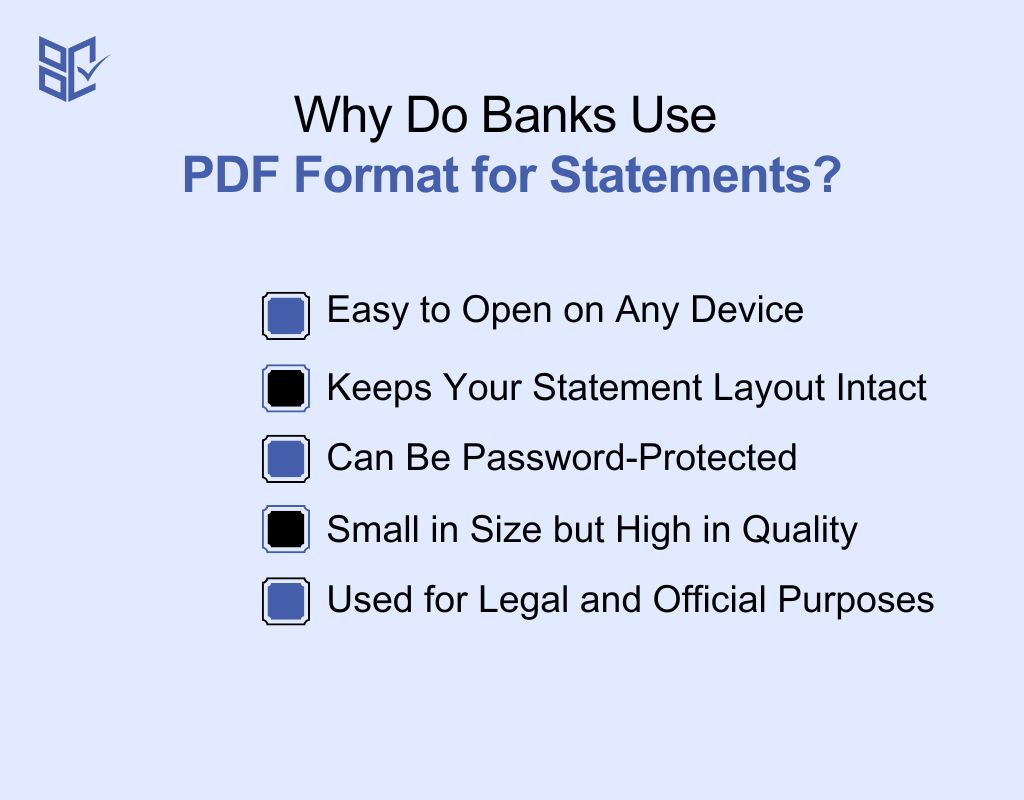

Why Do Banks Use PDF Format for Statements?

Banks prefer the PDF format for statements because it's secure, easy to access, and works on any device. Here are the key reasons why your bank chooses to use PDFs:

Easy to Open on Any Device

You can open a PDF on phones, tablets, or computers without needing special software. Most browsers or default apps already support it. This means you can quickly view your statement without downloading anything extra or struggling with file compatibility issues.

Keeps Your Statement Layout Intact

PDFs lock the layout of your bank statement. The fonts, tables, and formatting stay the same no matter where or how you open it. This is important when you need to print, share, or submit the file for official purposes.

Can Be Password-Protected

Banks often add passwords or encryption to your statement for privacy. This protects your financial data if the file is lost or sent by mistake. You stay in control, and unauthorized people can’t view your details without the password.

Small in Size but High in Quality

Despite including detailed transaction lists and graphics, PDF statements are lightweight files. They download quickly, take up little space, and load fast even on slower internet. Still, the quality remains high for reading, printing, or sharing whenever you need.

Used for Legal and Official Purposes

PDF statements are accepted by most institutions for tasks like visa applications, loan processing, or tax filing. They’re seen as trustworthy because they’re hard to edit and often come with bank-issued digital signatures or metadata that confirm their authenticity.

Top Tools to Convert PDF Bank Statement to Excel or CSV

Looking to convert your PDF bank statement into Excel or CSV format? These tools help you extract data quickly and keep the table structure intact. Let’s look at the top five options:

Bank Statement Converter

Bank Statement Converter is designed especially for PDF bank statement conversions. It supports OCR, layout detection, and works in-browser without any downloads. You can export to Excel or CSV formats easily. It’s fast, secure, and perfect for non-technical users who want clean, usable data from bank PDFs in just a few clicks.

Adobe Acrobat Pro

Adobe Acrobat Pro is a premium tool with powerful export features. It lets you convert scanned or digital bank statements into Excel with smart OCR. You can adjust layout settings and export accurate tables. While it’s paid, it offers high-quality results if you already use other Adobe tools for document handling or editing.

PDFTables

PDFTables is a web-based converter focused on turning PDFs into structured tables. It works well with PDF bank statements, especially those with clean layouts. You upload your file and get an Excel or CSV download instantly. It handles numbers and rows correctly, though complex or scanned files may need manual adjustment later.

Smallpdf

Smallpdf is a simple, user-friendly tool for general PDF tasks. You can drag and drop your bank statement, convert it to Excel, and download it right away. While it doesn’t have deep table recognition or OCR, it’s a good choice for well-formatted, text-based PDFs and quick one-time conversions.

iLovePDF

iLovePDF offers basic PDF to Excel conversion. It’s easy to use and works directly from your browser. However, it doesn’t handle scanned documents or complex bank statement layouts well. It’s a helpful tool for basic statements with simple data but may not suit detailed or multi-page financial records.

How to Convert PDF Bank Statement to Excel Free

Converting your PDF bank statement to Excel lets you analyze, filter, or share your data more easily. Follow these simple steps to turn your PDF into a working spreadsheet:

Upload Your PDF Statement to a Converter

Start by choosing a reliable tool like Bank Statement Converter. Click the upload button and select your PDF file. Drag-and-drop also works on most tools. Make sure the file isn’t password-protected, or remove the password beforehand. Once uploaded, the tool will prepare the file for conversion to Excel or CSV.

Enable OCR for Scanned Statements

If your PDF is scanned or image-based, enable OCR (Optical Character Recognition) in the tool’s settings. This helps the software read text from the image. Without OCR, your data may not appear correctly. Most good converters let you toggle this on with one click before processing the file.

Keep the Layout or Table Structure

To maintain rows and columns correctly, choose the option like “Keep Table Layout” or “Enable Table Detection.” This ensures your bank data doesn’t appear jumbled in Excel. It’s especially important for multi-page statements with repeating headers, balances, and transaction details formatted in columns.

Choose Output Format

After layout settings are applied, choose the format you want: Excel (.xlsx) for formatted sheets or CSV for plain data. Excel is better for editing and visuals. CSV is ideal for software imports. Pick based on your need—both give clean, usable results when converted properly.

Download and Review the File

Click “Convert” or “Export,” then download the output file. Open it to check if rows, columns, and numbers look correct. Fix any formatting issues if needed. Save it with a clear name like “March_Statement_2025.xlsx” so you can find it easily later for accounting or submission.

How to Download PDF Statements from Your Bank

Downloading your PDF bank statements is quick and simple. You just need to log into your online banking account and follow a few easy steps. Here's what you should do:

Log Into Your Online Banking Portal

Start by visiting your bank’s official website or mobile app. Enter your username and password to log in. Make sure you’re on a secure connection (look for “https”). If you’re using public Wi-Fi, it’s better to wait and log in later from a private network.

Go to the 'Statements' or 'Documents' Section

Once you're inside your account, look for a menu or tab labeled "Statements," "Documents," or sometimes "eStatements." This section stores your monthly or quarterly statement files. Some banks also list them under “Account Activity” or “Download Center” depending on how their system is set up.

Choose the Date Range You Need

Pick the statement period you want to download. It can be for one month, three months, or a custom range. Make sure the date range covers the time you need—especially if you're using it for tax filing, visa applications, or other official paperwork.

Click Download and Save as PDF

After selecting the date range, click on the "Download" or "Export" button. Choose the PDF format if multiple options appear. Save the file to a folder you can easily access later. Rename the file if needed to keep your documents organized for future use.

Check for Password or Security Prompts

Some banks protect PDF files with a password. If prompted, look for the password sent via email or SMS. Don’t forget to note it down. Always keep your statements safe and never share your file or its password with anyone you don’t fully trust.

How to Edit a PDF Bank Statement

You might need to edit a PDF bank statement for valid reasons like highlighting, redacting personal info, or adding notes. Here’s how to do it the right way using safe tools:

Use a Trusted PDF Editor

Choose a reliable tool like Adobe Acrobat, or PDFescape. These allow you to make edits directly in the PDF. You can add comments, highlights, or shapes. Don’t use unknown or shady tools—your bank statement has sensitive data, and safety should always come first.

Redact or Hide Personal Information

Sometimes, you may want to hide your address or account number before sharing the file. Use the redact feature in your PDF editor to permanently black out details. Avoid simply drawing a box over text—it can be removed. Proper redaction ensures no one can recover what you hide.

Add Notes or Annotations

If you're sharing your statement with an accountant or a loan officer, you can highlight certain transactions and add short comments. This helps explain unusual activity or provide context. Most PDF editors have tools to insert sticky notes, underlines, or highlights for this purpose.

Don’t Alter Actual Transaction Details

Editing the amounts, dates, or transaction list is risky and often illegal. These records represent your official financial history. Faking or modifying this data can lead to serious consequences. Only make non-destructive edits, and always keep the original file unchanged for your records.

Save a Copy Before You Edit

Before making any changes, save a copy of the original PDF. This way, if anything goes wrong or you need to start over, you still have the unedited version. Keep both files clearly labeled to avoid confusion when sharing or submitting them later.

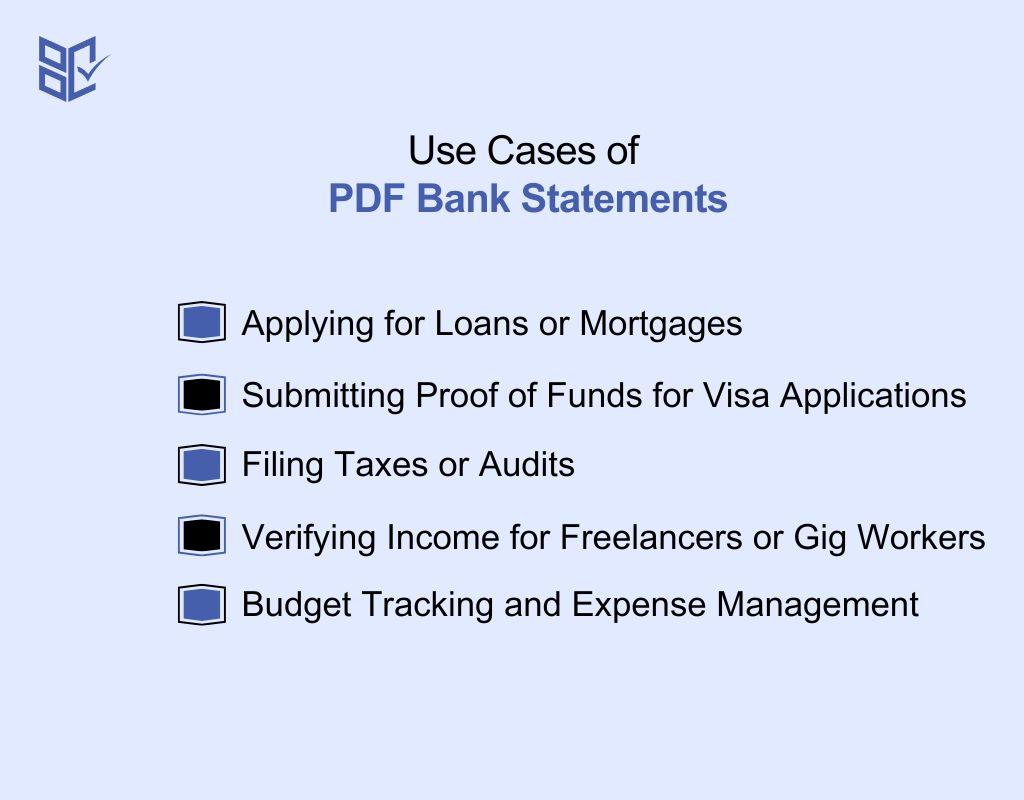

Use Cases of PDF Bank Statements

PDF bank statements are useful in many everyday and official situations. They’re accepted by banks, government agencies, and employers because they are easy to read, print, and verify. Here’s how you might use them:

Applying for Loans or Mortgages

Lenders often ask for your recent bank statements to check your income, expenses, and savings. Submitting a clear PDF file makes the process smoother. It shows your financial habits and helps prove that you’re capable of managing monthly repayments based on your regular cash flow and account balance.

Submitting Proof of Funds for Visa Applications

Visa officers need to verify that you can support yourself while traveling. A PDF bank statement with your name, account number, and recent transactions helps prove financial stability. It’s a simple way to meet visa requirements for students, tourists, or work permit applicants without any added paperwork.

Filing Taxes or Audits

When preparing your taxes, you may need to report income, donations, or business expenses. PDF bank statements offer a clear record of every transaction. In case of an audit, you can present them as official evidence. Keeping monthly statements organized saves time and helps avoid unnecessary stress later.

Verifying Income for Freelancers or Gig Workers

If you don’t get regular pay stubs, your PDF bank statement can act as income proof. Whether you’re applying for a lease or loan, showing consistent deposits from clients helps build trust. Many landlords and institutions accept this as part of your financial documentation package.

Budget Tracking and Expense Management

You can review your PDF statement to track spending, identify recurring charges, and set savings goals. Highlighting categories like food, utilities, and subscriptions gives you better control over your money. It’s an easy way to spot waste and adjust your habits without needing fancy budgeting tools.

Conclusion

A PDF bank statement isn’t just a file—it’s a key part of how you manage your money. It helps with everything from tracking your expenses to applying for loans or visas. By learning how to view, convert, and edit it safely, you save time and avoid mistakes.

Now that you understand how it works, you can use your statements smarter—for budgeting, tax filing, or sharing when needed. Keep your files secure, and always download from trusted sources.

Frequently Asked Question

Can I use a PDF bank statement as proof of address?

Yes, if it shows your full name, current address, and a recent date (within 3 months). Many institutions accept it, especially for KYC, utility setup, or verification purposes, as long as the document is clear and official.

Why won’t my PDF bank statement open?

Your PDF statement might be password-protected. Banks often send these passwords separately via SMS or email. Also, ensure you're using a compatible PDF reader like Adobe Acrobat or a browser that supports encrypted PDF file viewing properly.

Can I print a PDF bank statement for submission?

Yes, you can print it for official use. Set your printer to “actual size” to maintain layout accuracy. Avoid scaling options that may cut off headers, footers, or side margins. Ensure clarity and completeness before submitting.